Automate your sales tax calculations and ensure tax compliance in the US or Canada with Brikl's integration to TaxJar.

Tax compliance can be daunting and time-consuming. With ever-changing tax laws and regulations, it can be difficult for businesses to navigate the different rules and rates for each state, and even more challenging to calculate and file sales taxes in a timely and accurate manner.

Fortunately, Brikl's integration with TaxJar can do most of the tax-related work for you. Follow the instructions below to automatize the entire sales tax calculation process and guarantee your business' tax compliance.

Before you get started with TaxJar integration

Before leveraging automatic tax calculations to guarantee tax compliance for your business, you must set up a few things in your Brikl account.

Set up your store address

Your store address will be used as the origin address for all tax calculations, so ensure it is set up correctly under Settings > Information. If you still need to set up your store address, refer to Where to find your business settings.

Add products to your catalog

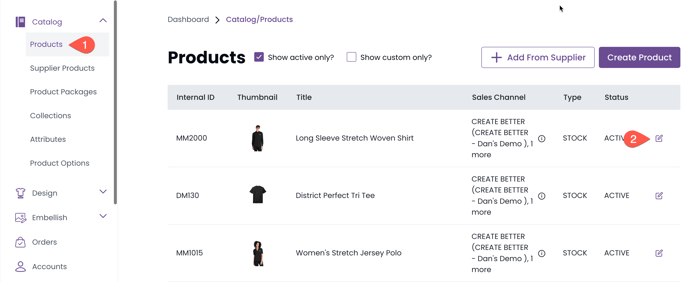

Also, you must have products in your catalog (Catalog > Products). Refer to How to add a product if you still need to add products to your catalog.

How taxes are calculated

Brikl's integration with TaxJar eliminates the need for businesses to manually research and calculate sales tax rates, which can be time-consuming and prone to errors.

Brikl will use the origin and destination information in an order's shipping details to have TaxJar determine if the sales tax calculations should follow Origin-based or Destination-based rules. Learn more about these rules on Origin-Based and Destination-Based Sales Tax Rate.

TaxJar takes into account the various tax rates for state, county, and city taxes in the US, as well as any special tax rules for specific products or services. TaxJar's engine guarantees more than 99% of accuracy in sales tax calculation.

TaxJar automates the filing and remittance process, eliminates the need for businesses to navigate the different rules and rates for each state, and provides detailed reporting and compliance management tools.

⚠️ By default, all products will be taxed at the default tax rate for the state. If you require a specific product to be taxed at a different rate, jump to How to set tax rates for specific products. If you need to exempt products from taxes, jump to How to exempt products from taxation.

Setting up your TaxJar integration

Follow the steps below to integrate your Brikl account and TaxJar.

Step 1: Create a TaxJar account.

Sign up for TaxJar and log in to your account. You can start with a free account, which gives you 30-day access to all features in the TaxJar platform.

The 30-day free trial is sufficient time to integrate your Brikl account with TaxJar. However, to ensure that your integration continues to work after the end of the trial, you will need to upgrade your TaxJar plan to Professional, as Brikl integrates with TaxJar through the TaxJar API, which is only available in the Professional plan.

Step 2: Set up your sales tax nexus

Sales tax nexus occurs when a business has a connection to a state. This connection gives the state the authority to require a business to collect and pay sales taxes on transactions within that state.

Once you have a TaxJar account, the next step is to add your states with nexus.

Step 3: Obtain TaxJar API Tokens

Visit the TaxJar API Token page to get your Live Token and Sandbox Token.

The Sandbox Token allows Brikl to test integrations without affecting actual data. It's used to check if order data is being transmitted correctly, if the nexus setup is correct, and if tax calculations are accurate.

Once your integration is complete and tested, the Live Token will replace the Sandbox Token, and TaxJar will start to use your actual data.

⚠️ Note that the TaxJar API is available only for users with a Professional plan. If you're using a free account, you'll be able to use the TaxJar API for only 30 days. Make sure you update your account within this period.

Step 4: Contact Brikl Support

Contact Brikl Support or your account manager and provide your API Tokens. Our integration team we'll use them to connect your Brikl and TaxJar accounts and get the tax calculations working.

How to set tax rates for specific products

By default, all products will be taxed at the default tax rate for the state. If you require a specific product to be taxed at a different rate, you’ll need to add the proper tax code for the product.

Brikl uses metadata fields on a product level to let you set tax codes for a particular product. To do so, go to Catalog > Products and select a product.

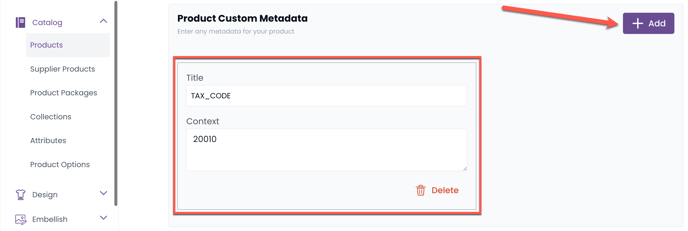

On the product page, scroll down to "Product Custom Metadata" and click the "Add" button. Then, add TAX_CODE as the title and the proper tax code in the context field. You can see the list of available tax codes in the Product Category Library within your TaxJar account. In the screenshot below, we're using the generic code for clothing: 20010.

How to exempt products from taxation

If you need a product to be tax-exempt, consult your account manager or contact Brikl Support, and we'll arrange to have that product ignored in calculations.

Frequently asked questions (FAQ)

- How to exempt all products from a MicroStore from taxation?

Contact Brikl Support, and we’ll make sure that taxes will always be 0% for all sales on that specific MicroStore. - What if I have financial software that already creates transactions in TaxJar?

If you are already using financial software that creates transactions in TaxJar or only needs TaxJar to perform tax calculations and not create transactions, please let us know. We will adjust the integration only to calculate taxes during the cart checkout process. - Are fundraising fees and other additional fees taxed?

Currently, any additional fees you charge customers are not subject to taxes by default. However, we are developing the ability to have "Taxable Fees," which will be available soon. If you need this feature immediately, please contact Brikl Support or your account manager, and we can provide a temporary solution.